Blogs

To decide APY, we noted the pace considering to your 17 some other terms. To rank customer support, i reported how the creditors have been examined to your Trustpilot plus the Better business bureau. We checked the fresh regards to 144 Cds supplied by 84 banks and you can borrowing unions to reach our very own ratings. There are only three conditions (half a dozen, a dozen and you can 2 yrs), however, for each will pay a higher produce than just mediocre. You need merely $step one,100000 to begin with protecting and also the Cds feature everyday compounding interest.

Newest Rising Lender Cd Prices

An excellent Computer game hierarchy is actually a cost savings approach where you dedicate within the several Dvds various conditions. The new tax enforce after you have the money from the Video game — whether you are taking regular interest repayments otherwise hold back until they matures. You should spend fees to the produce even although you replace the new Video game otherwise move it over for the some other deposit.

Common Gold

Typically, it has advanced to become a frontrunner in the metals world, giving an array of functions in addition to silver and gold bullion pubs and you will gold coins, rare metal polishing, and you can jewellry. “Looking at our interior analysis, i noticed that one million taxpayers missed saying it cutting-edge borrowing once they have been in reality eligible,” Internal revenue service Administrator Danny Werfel said within the a statement. “To minimize headaches and now have that it money so you can qualified taxpayers, we have been making these money automatic, meaning they won’t be necessary to glance at the detailed procedure of submitting a revised come back to discovered it.” Really Dvds charge a fee a penalty to possess being able to access the amount of money just before the definition of try right up. But not, particular financial institutions offer no-penalty Dvds — also known as liquid Dvds — that allow you to withdraw the bucks very early without getting billed a penalty.

Lauren Ward is a writer just who covers all things personal fund, along with banking, a home, small enterprises, and a lot more. Research the financial’s character because of consumer ratings, ratings to your financial other sites and account out of regulating businesses. Which protects their places around $250,100 for every depositor, for each business. Really Cd cost got currently peaked before the Fed’s choice to slice rates. Because the marketplace for borrowing products wants coming trend, the consequences away from following FOMC rate cuts are shown within the prices through to the real incisions occur. Concurrently, we valued accounts with lower minimal deposits, daily material attention dates (unlike month-to-month) and people who are available to individuals, regardless of where it live.

Easily asked you whether or not you’d be satisfied with something average, or https://happy-gambler.com/gamebookers-casino/ something greatest, what might you go searching for? Don’t accept an average speed, go for the best give, that is two times or even more than just mediocre. Which have large sums and over go out, the real difference in your return can be more than just you will fulfill the eye.

It’s the advanced-size of banks you to support the most reciprocal deposits. These banks is actually adequate to possess people that have higher deposits yet still quick sufficient that they was permitted to fail. There is certainly an obvious escalation in the pace from development of such places performing after 2018, a posture that’s likely due to the brand new courtroom changes explained more than. A lot more striking, however, is the 20 percent increase in 2023 to possess banking companies with assets ranging from $step one billion and $100 billion. These banking institutions turned to reciprocal places inside financial disorder to increase active insurance coverage restrictions because of their customers. Bankrate.com try an independent, advertising-served blogger and research solution.

Identity

Percentage cash improved $cuatro.3 million, otherwise 12%, than the 4Q 2023, due to development in Institutional Characteristics, Individual Riches Administration, and you will BMT out of DE. Overall noninterest debts enhanced $dos.9 million driven because of the salaries and you may professionals bills out of hiring the brand new advisors and gratification-centered compensation. Core noninterest bills enhanced $27.2 million, or 19%, compared to the 4Q 2023.

- More striking, however, ‘s the 20 percent escalation in 2023 to own banks having possessions ranging from $1 billion and you can $one hundred billion.

- It membership will secure a produce currently around seven moments more than the brand new national mediocre.

- The utmost percentage might possibly be $step one,eight hundred for every private and will are different centered on issues, with regards to the Internal revenue service.

Michelangelo very first achieved to see in his twenties for their statues out of the the brand new Pietà (1499) and you will David (1501) and you can cemented its fame to the tolerance frescoes out of your Sistine Chapel (1508–12). He had been notable for his means’s complexity, bodily reality, mental tension, and you may careful said from place, light, and you will shadow. Of a lot publishers provides mentioned to your its capability to change brick to your flesh and also to imbue his decorated number with moments. Michelangelo’s talent existed recognized regarding the then many years, and therefore their fame provides suffered with on the 21st millennium. The brand new bullet (tondo) mode is actually old-fashioned to possess individual earnings and Michelangelo designed the new in depth silver created wood body type.

Compare finest Cd prices today from the identity

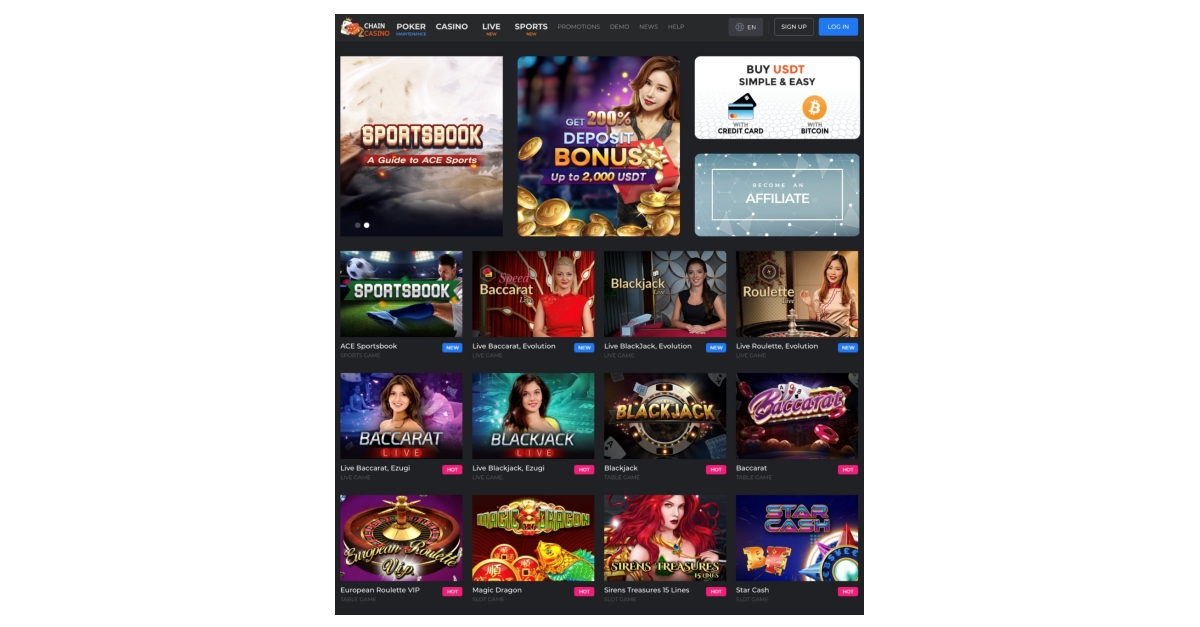

Mutual deposits is actually dumps exchanged anywhere between banking companies in order to effortlessly improve deposit insurance rates. That it Financial Remarks identifies what they are, their link with brokered dumps, exactly how its legal treatment has evolved over time, and and therefore financial institutions use them more. Sweeps gambling enterprises provide actual online casino games no deposit expected and you may money packages offered for under $step one.

Publication really worth for every display increased $3.22, or 8%, and you can real publication really worth per display improved $2.97, or twelve%, compared to 4Q 2023. The newest deposit feet remains really-diversified, having 51% from buyers deposits from the Commercial, Small business, and you will Money and you will Faith business lines. The mortgage-to-deposit proportion(3) are 77% in the December 30, 2024, delivering went on power to finance coming loan development. Such decreases was partly counterbalance because of the a growth out of $27.0 million inside residential mortgage, as a result of the retention from certain finance according to favorable production and matchmaking potential. (2) Because the utilized in which pr release, key ROA, center EPS and core ROTCE is low-GAAP economic actions.